Introduction

With £5.7 billion paid in UK home insurance claims in 2024, insurers face unprecedented pressure to maintain customer relationships whilst managing escalating costs. Yet with 84% of customers actively shopping around at renewal and 87% of switchers leaving purely for cheaper premiums, the industry haemorrhages billions in lost lifetime value annually.

This retention crisis stems from a fundamental disconnect: acquiring a new customer costs up to 9 times more than retaining an existing one, yet insurers typically only engage with customers at claim time or renewal. The result? 43% of policyholders believe their insurance either lacks value or are uncertain about its worth, leaving insurers competing solely on price in a race to the bottom.

The industry's reactive approach to customer relationships creates a vicious cycle. Without meaningful engagement throughout the policy lifecycle, insurers struggle to demonstrate value beyond price. When 84% of customers are comparing quotes at renewal, and nearly half doubt their policy's worth, retention becomes an expensive battle of discounts and desperation.

Agentic AI transforms this dynamic by enabling systematic, personalised follow-up communications across appropriate channels that maintain engagement throughout the policy lifecycle. Rather than bombarding customers with sales calls, insurers can deliver valuable, timely information via customers' preferred channels—whether that's weather alerts via SMS, helpful content via email, or annual reviews via phone.

Research shows that increasing customer retention by just 5% can grow an insurance company's profits by up to 95%. AI-driven engagement strategies help insurers capture this opportunity by transforming reactive, price-focused relationships into proactive partnerships that demonstrate ongoing value.

Understanding AI Agents in Insurance Follow-Up

Follow-up represents the difference between transactional insurance relationships and genuine customer partnerships. In an industry where 84% of customers actively shop around at renewal, consistent engagement throughout the policy lifecycle becomes critical for retention success.

Traditional follow-up processes rely on generic renewal notices and occasional marketing campaigns that fail to address individual policyholder needs or demonstrate ongoing value. This leaves insurers competing solely on price when renewal time arrives, with 87% of switchers citing cost as their only reason for leaving.

How AI Agents Transform Follow-Up

AI agents can revolutionise the entire follow-up ecosystem, from policy inception through claims resolution and beyond. Agentic AI systems integrate with your policy administration system, claims databases, and customer communication platforms to:

Monitor policy milestones and trigger personalised communications

Help identify coverage gaps based on life events and external data

Facilitate proactive risk assessments and prevention outreach

Support renewal processes with tailored recommendations

Maintain post-claim engagement to help ensure satisfaction

Implementation in Insurance Operations

AI agents connect seamlessly to existing insurance infrastructure without system replacement. Agentic AI solutions learn your specific product offerings, underwriting guidelines, and customer segments, then can begin orchestrating follow-up campaigns automatically. Whether reaching out about severe weather preparation before storm season or checking in after a claim settlement, AI-powered communications help ensure consistent, valuable touchpoints that strengthen customer relationships.

Use Case: Multi-Channel Home Insurance Claim Follow-Up

Scenario: A policyholder reported storm damage to their roof and fence during last month's severe weather. They've completed emergency repairs and their £4,500 claim has just been approved. The insurer needs to maintain appropriate engagement throughout the claims journey and beyond.

Traditional Process Challenges: Standard follow-up typically involves generic email surveys that achieve low response rates, missing opportunities to ensure smooth claims completion, verify customer satisfaction, and build loyalty through valuable, timely communications delivered via customers' preferred channels.

AI Agent Solution - Multi-Channel Approach:

SMS Claim Approval (Day 0):When the claim is approved, the AI agent sends an immediate text: "Good news! Your storm damage claim for £4,500 has been approved. Payment will reach your account within 3-5 working days. Any questions? Reply or call [number]." Clear, informative, and opens a response channel.Email with Claims Summary (Day 1):The agent sends a detailed email containing the claims settlement breakdown, direct contact for their adjuster if questions arise, and helpful information about keeping receipts for any additional emergency repairs. Professional documentation when they need it for their records.SMS Payment Confirmation (Day 5):Once payment is processed, a simple text confirms: "Your £4,500 claim payment has been sent to your account ending [XXXX]. Thank you for choosing [Insurer]." Brief confirmation that closes the loop on their claim.Weather Alert SMS (As Needed):Only when the Met Office issues severe weather warnings for their area, the agent sends: "Storm warning for [Town] tomorrow. After your recent claim, a reminder to secure loose items and check temporary repairs are holding. Stay safe." Thoughtful, relevant given their recent experience.Annual Policy Review Email (Month 10 of Policy):When their policy anniversary approaches, the agent sends an email: "Your annual policy review is due. Have you made any home improvements since your storm claim that we should know about? Your renewal is in 60 days. Click here to update your details or request a callback." This ensures proper coverage adjustments and demonstrates ongoing care beyond the claim event.Channel Strategy:Each touchpoint serves a specific purpose: SMS for time-sensitive updates, email for detailed documentation, and phone calls only offered as an option rather than pushed. The sequence combines claim-related follow-up in the immediate aftermath with ongoing policy lifecycle management, demonstrating value at both critical moments and routine touchpoints.

Beyond Individual Policies: Broader AI Agent Capabilities

AI agents extend their multi-channel follow-up capabilities across the entire insurance customer lifecycle:

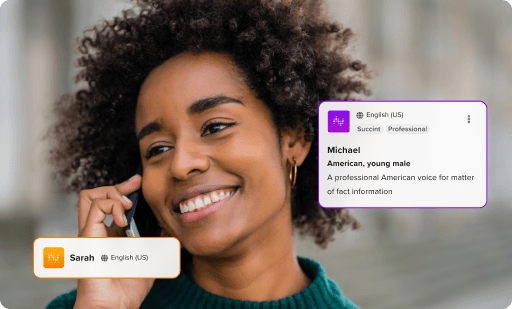

Smart Channel Selection:AI agents can analyse customer behaviour to determine optimal communication channels for different message types. Urgent weather warnings via SMS typically achieve very high open rates, detailed policy information via email allows customers to review at their convenience, whilst annual reviews via phone can enable meaningful conversation about changing needs.Behavioural Response Tracking:Agentic AI systems monitor how customers engage across channels, automatically adjusting strategies based on what works. If a customer never answers phone calls but always responds to texts, the system can adapt accordingly whilst maintaining comprehensive interaction logs for compliance.Value-First Communication:AI-powered platforms can prioritise genuinely helpful content over sales messages. This may include location-based severe weather alerts, seasonal home maintenance reminders tailored to property age, claims prevention tips based on common risks in their area, and regulatory updates that affect their coverage.Preference Learning:Through subtle pattern recognition, agentic AI technology can learn not just channel preferences but timing and frequency tolerance. Some customers appreciate quarterly check-ins; others prefer annual contact only. These systems can respect these implicit preferences whilst helping ensure critical communications aren't missed.

The follow-up process transforms insurance from intrusive sales to valuable service. AI agents ensure every touchpoint adds genuine value whilst respecting customer preferences.

Case Study: Leading South African Home Insurer

Old Mutual implemented ConnexAI's AI agent technology for automated customer engagement campaigns. Key results included:

100 customer contacts per hour:AI agents achieved volume that would take human agents a month to complete manuallySystematic multi-channel engagement:Deployed across SMS, email, and voice for comprehensive policyholder outreachScalable capacity without proportional costs:Enabled business growth without operational bottlenecksMaintained service quality standards:Achieved high-volume outreach whilst preserving the quality that previously required human handling

Their transformation demonstrates how insurers can dramatically increase customer touchpoints throughout the policy lifecycle without overwhelming operational resources or compromising service standards.

The Strategic Advantage of AI-Powered Follow-Up

Insurance companies leveraging AI agents for systematic follow-up are fundamentally repositioning themselves in customers' minds. In an industry where 84% of policyholders shop around at renewal and 87% who switch do so purely for price, maintaining meaningful engagement between renewals becomes essential for survival.

Agentic AI solutions address core industry challenges: with customer acquisition costing up to 9 times more than retention, insurers must find ways to demonstrate value beyond premiums. AI-powered communications can resolve this tension by creating meaningful touchpoints that add value without adding cost, potentially building relationships that transcend price competition.

For insurers seeking to improve retention rates without expanding service teams, capture the 95% profit increase potential from just 5% better retention, and build sustainable competitive advantage through superior customer relationships, AI agents represent proven technology already helping to transform the UK insurance landscape.

Getting Started with AI Implementation

Discover how ConnexAI's agentic AI platform can transform follow-up processes for your insurance operations.

Request a demo of our Insurance AI technology: connex.ai/contact-usRead more about our Agentic AI solutions for Insurers: connex.ai/solutions/insuranceDownload our free guide to Transforming Insurance Operations with AI below.

FAQ's

AI Agents for Insurance Follow-Up

Sources

£5.7 billion in UK home insurance claims 2024: Association of British Insurers - https://www.abi.org.uk/news/news-articles/2024/112/year-to-date-property-claims-payouts-hit-4.1-billion/

84% shop around at renewal: Capacity Insights - https://capacityinsights.co.uk/news-and-insights/customer-retention-insurance/

9x more expensive to acquire new customers: Capacity Insights - https://capacityinsights.co.uk/news-and-insights/customer-retention-insurance/

87% switch for cheaper policies: Mintel UK Home Insurance Market Report 2025 - https://store.mintel.com/report/uk-home-insurance-market-report

43% uncertain about policy value: Mintel UK Home Insurance Market Report 2025 - https://store.mintel.com/report/uk-home-insurance-market-report

5% retention increase = 95% profit growth: Capacity Insights - https://capacityinsights.co.uk/news-and-insights/customer-retention-insurance/

Old Mutual 100 contacts per hour: ConnexAI implementation data - https://connex.ai/case-studies/

FCA compliance and TCF principles: Financial Conduct Authority - https://www.fca.org.uk/firms/fair-treatment-customers

Note: Some statistics are based on ConnexAI client data and industry research. Actual results may vary based on insurer size, market segment, and implementation approach.

Resource Download

Fill in the below form to access the content.