Introduction

The insurance industry suffers some of the highest drop-off rates of any consumer sector. Nearly half of applicants (47%) abandon online forms (TransUnion), and only about 10% complete a fully digital purchase—leaving roughly 90% who either drop out or switch to offline channels (BCG). Many customers encounter friction during the online buying process: around 75% report issues such as confusing forms, unclear pricing or coverage details, technical glitches, or slow responses that force them to complete their purchase offline (Accenture).

These issues are costly. Traditional quote and intake processes can increase operating expenses and lower conversion rates, leading to lost premiums, slower growth, and potential customers choosing competitors who respond more quickly.

Agentic AI can improve this process. It automates and speeds up intake and quotes, processing applications quickly and reliably, even outside regular business hours. This reduces abandonment, allows capacity to scale without additional staff, and delivers a smoother, more consistent customer experience.

Understanding AI Agents in Insurance Intake

Intake is a critical point in the insurance customer journey, where interest must turn into an active policy. Traditional intake methods like calls, forms, and emails often create friction at the moment insurers need efficiency and professionalism most.

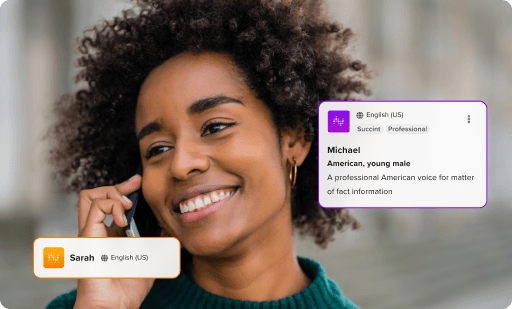

AI agents offer a different approach. They can manage the entire intake process autonomously and integrate directly with an insurer’s systems. AI agents collect customer information conversationally through web, phone, or chat channels, perform instant eligibility checks such as driving records or credit history, and ensure compliance with regulatory rules. They can also create structured customer and policy records in your CRM or agency management system, including all required data fields. By automating data capture, insurers report significant reduction in manual data-entry errors and higher employee productivity.

In practice, an AI agent can respond immediately to a quote request, even at midnight. It asks targeted questions, validates responses against databases such as the DMV or insurance history, and builds a complete policy application record. The system then routes the case to the appropriate underwriter or agent, allowing human staff to focus on higher-value tasks. The result is a seamless, professional onboarding process that is always available, efficient, and reliable.

Use Case: Auto Insurance Quote Request

Scenario:

A driver seeks a new auto insurance quote after buying a car. They visit the insurer’s website or call the company outside business hours.

Traditional Process Challenges:

In a manual process, this requires waiting for an available agent, filling lengthy forms or scheduling callbacks. Complex verification (license checks, risk assessments) and paperwork lead to delays. Many prospects abandon the process; agents lose revenue and marketing spend on cold leads.

AI Agent Solution – Step-by-Step

Initial Contact:The prospect requests an auto insurance quote via the insurer’s website or a phone call. The AI agent engages immediately (24/7 availability), greeting them and confirming intent.Preliminary Assessment:The agent asks key qualifying questions, like “What year and model is your vehicle? Have you had any recent violations or claims?” to gauge the applicant’s risk profile and coverage needs.Driving Record Check:The AI agent automatically performs a motor-vehicle-record lookup using the provided license number. It checks for disqualifying infractions or recent claims. (This replaces a manual DMV query by staff.)Information Gathering:In a natural, guided conversation, the agent collects all required details: driver’s name, birthdate, address, vehicle VIN, current insurer (if any), desired coverage levels, etc. It adapts questions based on earlier answers to ensure no needed information is missed.Verification:The agent verifies the provided data; for example, confirming identity through a credit bureau lookup and validating the address. It ensures the customer is eligible (e.g. the vehicle is registered and the driver is licensed).CRM Integration:Once all data is collected, the AI agent creates a complete customer/profile record in the insurer’s CRM and policy management systems. It populates every field (risk factors, coverage details, application metadata) according to underwriting standards, eliminating manual entry.Documentation:The agent generates the preliminary quote documents and any required disclosures or pre-policy forms. It sends these (via email or secure portal) to the customer for review and electronic acknowledgment, clearly explaining next steps.Team Assignment:Based on factors like risk level and coverage type, the agent assigns the application to the appropriate underwriter or agent. That team member receives a full intake summary, so no information is lost or need be re-collected.Automated Follow-Up Workflow:The AI schedules any necessary follow-up; for example, a reminder to sign documents or a callback in 24 hours to discuss payment. It creates tasks in the CRM for the human team (e.g. “Verify coverage acceptance”) and sets up automated outreach touches (emails or texts) to keep the prospect engaged through the policy binding process.

Beyond Initial Intake: Broader AI Agent Capabilities

AI agents add value far beyond just the first contact, enhancing the customer lifecycle across insurance operations:

Automated Policy Renewals & Retention: AI agents can proactively notify policyholders of upcoming renewals, collect updated information (new vehicles, drivers, etc.), and even send renewal quotes or discounts. This ensures higher retention, as customers are smoothly guided through updates. By keeping constant engagement, insurers reduce lapse rates.

Claims Triage & Initial Support: After an intake, AI agents can transition to the claims phase by handling first-notice-of-loss calls. They gather incident details conversationally, schedule inspections or appoint loss adjusters, and update claim systems automatically, speeding resolution.

24/7 Customer Service & Support: Outside of intake, AI agents can answer common policyholder queries (e.g. coverage questions, billing status) any time of day. Real-world deployments show that AI-driven chatbots and virtual assistants cut repeat customer inquiries and improve first-call resolution. This continuous support boosts satisfaction without adding staff.

Personalized Cross-Selling & Engagement: AI agents can analyze profiles in real-time to recommend relevant add-ons or new products (e.g. umbrella coverage, roadside assistance) during natural conversations. By personalizing offers based on customer data, insurers see higher conversion on cross-sell.

These capabilities ensure intake becomes the strong foundation of the customer relationship. Even during peak demand (for example after a storm when many customers call, or during a busy sales campaign), AI agents maintain consistent intake capacity while staff handle complex tasks. For insurers, this means faster quote-to-policy conversion while upholding underwriting standards.

Real-World Impact: Insurance Broker Success

Old Mutual iWYZE, a major insurer within the Old Mutual Group, partnered with ConnexAI to transform its customer engagement and key operational processes. Before adopting ConnexAI’s agentic AI platform, the company dealt with fragmented channels, inconsistent experiences, and inefficiencies that limited its ability to scale.

By integrating ConnexAI’s AI-driven tools—including AI Agents, real-time analytics, automated quality assurance, and AI Voice—Old Mutual iWYZE unified customer interactions and streamlined core workflows. Disjointed systems were replaced with an intelligent automation backbone supporting both front-line engagement and back-office productivity.

This overhaul automated time-consuming tasks such as managing omnichannel communications, maintaining service consistency, and scaling outreach. AI Agents significantly increased customer contact volume without added costs, while Quality AI delivered 100% interaction coverage and real-time insights to improve service performance.

100 customer contacts per hour:AI agents achieved volume that would take human agents a month to complete manually.Systematic multi-channel engagement:Deployed across SMS, email, and voice for comprehensive policyholder outreach.Scalable capacity without proportional costs:Enabled business growth without operational bottlenecks.Maintained service quality standards:Achieved high-volume outreach whilst preserving the quality that previously required human handling.

Conclusion

Insurance organizations that streamline intake gain a significant competitive advantage. In a market where prospects compare multiple carriers online, the speed and professionalism of onboarding often determine whether a quote converts into a policy. Insurers relying on slow, manual processes such as handoffs, callbacks, and paper forms risk losing customers to competitors offering instant, frictionless onboarding.

AI agents address this challenge by providing fast, professional processing while maintaining the checks and compliance insurers require. They offer instant, 24/7 intake, driving higher conversion rates from inquiry to customer and reducing administrative burden. For insurers aiming to grow their policy base, shorten time-to-coverage, and eliminate drop-offs, AI agents turn intake from an operational bottleneck into a strategic advantage.

Kickstart Your AI Journey

See how ConnexAI’s agentic AI platform can revolutionize intake processes in your insurance operations.

Request a demo of our Insurance AI technology: connex.ai/contact-usLearn more about our Agentic AI solutions for insurers: connex.ai/solutions/insurance